More Than Good Cheer: You Need Reliable Auto Insurance for the Holiday Season!

o Allstate: 15% refund for April and May premiums.

o Geico: 15% discount for both renewing and new policyholders

o State Farm: $200 million dividend to customers, approximately 25% discount per customer

o Progressive: $1 billion refund, with 20% refund for personal auto insurance customers

o AAA: 20% premium refund for two months for active policyholders before May 31

o Nationalwide: $50 one-time refund for auto insurance customers

During the pandemic, many insurance companies refunded part of auto insurance premiums to customers! Which company are you with? Did you receive this "subsidy"?

October is just around the corner, and with Christmas trees already appearing in stores, the holiday season isn't far away! Want to escape this exhausting period and relax a bit? The vastness of the U.S. makes it impossible to get anywhere without a car.

Whether you're a new international student or a long-time immigrant, in the U.S., no car means no mobility. And with a car comes the necessity of auto insurance, which is legally required in most states.

Even if you've purchased auto insurance many times, when it's time to renew, the variety of options can still be overwhelming. Which company to choose? What's full coverage vs. liability-only? Should you follow friends' recommendations?

Ding dong! iTalkBB has prepared an auto insurance guide for you, so you'll never have to worry about it again!

Four Steps to DIY Auto Insurance

Depending on driving habits and car usage, everyone's insurance needs differ. Online options often push either the cheapest or the most comprehensive plans—but are they right for you?

Step 1: Understand the Three Main Types of Coverage

A complete auto insurance policy typically includes these three optional coverage types.

1. Liability Coverage—"Basic Insurance" This is the most essential and legally required coverage!

Liability coverage includes bodily injury liability and property damage liability. For example, if you accidentally hit someone, this insurance covers their medical bills and your car's repairs. It protects against losses you cause to others.

• ⚠️ Liability coverage won't pay for repairs if you're not at fault! Unless the other party is at fault, their liability insurance will cover your repairs. For instance, if a drunk driver rear-ends you but their coverage is insufficient, collision coverage becomes crucial.

2. Comprehensive Coverage

Covers damage to your car from non-collision incidents. For example, if a tree falls on your car during a storm or it catches fire in a wildfire, comprehensive coverage applies.

3. Collision Coverage

If your car is involved in an accident or other collision, this coverage pays for repairs. Regardless of fault, collision coverage handles your car's repair costs.

Leased or financed car owners, take note! ⚠️ The law may require all three coverage types. In this case, skip to Step 3 to compare quotes for full coverage.

Step 2: How Much Coverage? How to Decide?

For mandatory liability coverage, there are three key components:

• Bodily injury per person

• Total bodily injury per accident

• Property damage

Generally, it's best to max out these coverages.

For example: $250K per person, $500K per accident, and $100K for property damage.

For a 2015 Subaru Forester, full coverage for six months costs $215. Halving these limits reduces the premium to $197—saving less than $20 over six months but slashing coverage by half. In an accident, you'd pay out-of-pocket for amounts exceeding your coverage, potentially facing financial ruin. Doubling coverage for a small premium increase is a wise investment.

For comprehensive and collision coverage:

Premiums depend on your deductible. Higher deductibles mean lower premiums. For example, choosing a $1,000 deductible over $100 can reduce premiums by over 60%.

Step 3: Compare Quotes for the Best Deal!

After deciding on coverage needs, the next step is choosing an insurer.

You can visit physical locations or use online tools. Many insurance apps let you upload personal details and compare quotes from multiple providers.

Step 4: Optimize for Savings

Many insurers offer bundled discounts. For example, combining home and auto insurance can lower costs. Another tip is to pay for a six-month policy upfront instead of monthly—monthly payments often cost more. If financially feasible, a six-month policy is more economical.

Key Takeaways

After all this, our goal is to secure the best-value auto insurance.

Here's the mantra: First, understand the three coverage types; next, decide how much to insure; then, compare multiple quotes; finally, optimize with bundles!

Of course, these four steps involve subjective decisions. Final premiums also depend on objective factors: driving history, age, gender, marital status, car make/year, location, credit score, usage, and occupation.

• Poor driving records may lead to denied coverage.

• Younger drivers pay higher premiums, which decrease until age 60, then rise again.

• Married individuals often get lower rates.

• Older or luxury cars cost more to insure.

• Densely populated, high-crime areas with many uninsured drivers mean higher premiums.

• Lower credit scores correlate with higher fraud rates, increasing costs.

• Low-mileage drivers or those in certain professions may qualify for discounts.

The best insurance can't replace a driver's mindfulness. Safe driving is the ultimate protection for yourself, loved ones, and property. Insurance covers accidents, but safe driving ensures peace.

Whether you received an insurance refund or not, stay safe on the road and secure at home—iTalkBB cares for your well-being! Consider using refunded premiums to upgrade your home security!

Endorsed by Lang Ping, coach of the Chinese Women's National Volleyball Team, iTalkBB AIjia home security products guarantee quality. With 17 years in the U.S., physical stores nationwide, and trilingual service (English, Mandarin, Cantonese), iTalkBB tailors security solutions for the Chinese community!

Special Offer: $0 Camera Purchase

Just $6.99/month per camera (2-year contract required)

Free shipping for a limited time

Visit our website for details

Or call sales: 1-877-482-5522

24/7 trilingual support for worry-free use!

Still unsure what home security cameras can do for you?

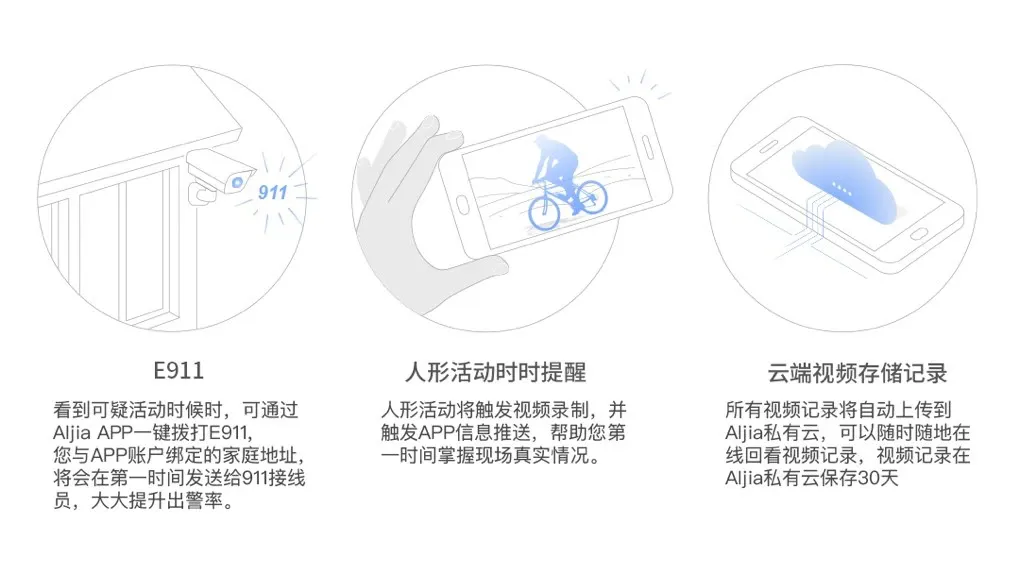

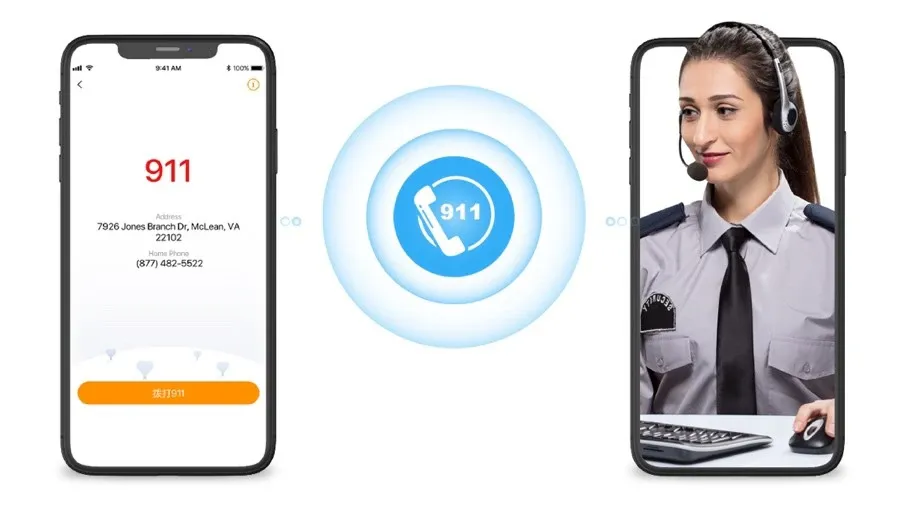

E911* Emergency Alert—Essential for Home Security Press one button in the AIjia app to call E911

Your registered home address is instantly shared with dispatchers

Significantly improves emergency response

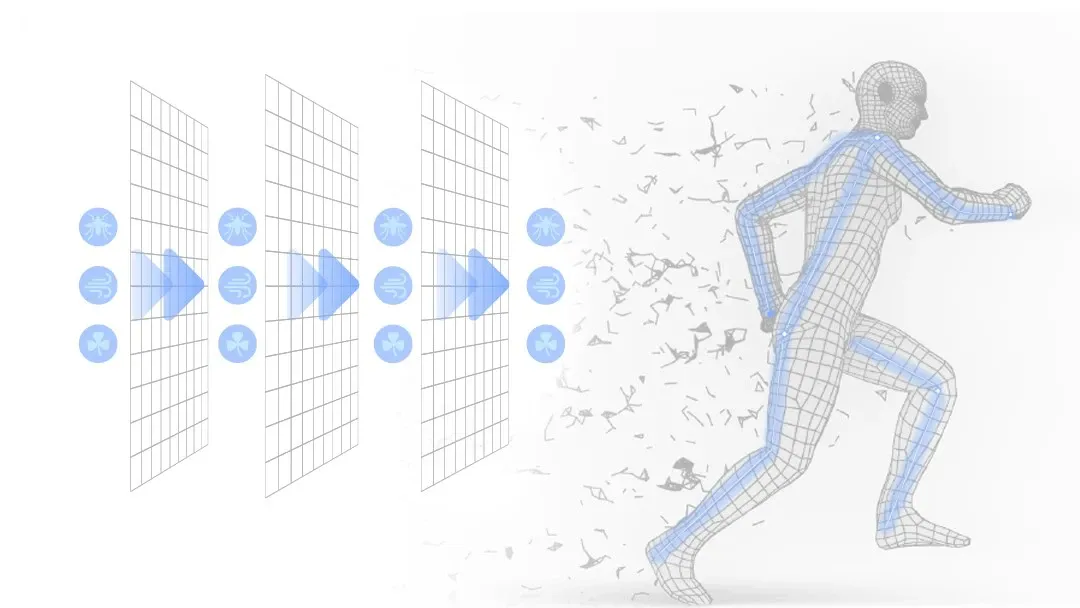

Real-Time Human Detection Alerts Advanced human shape recognition

Instant alert notifications

Filters irrelevant motion triggers

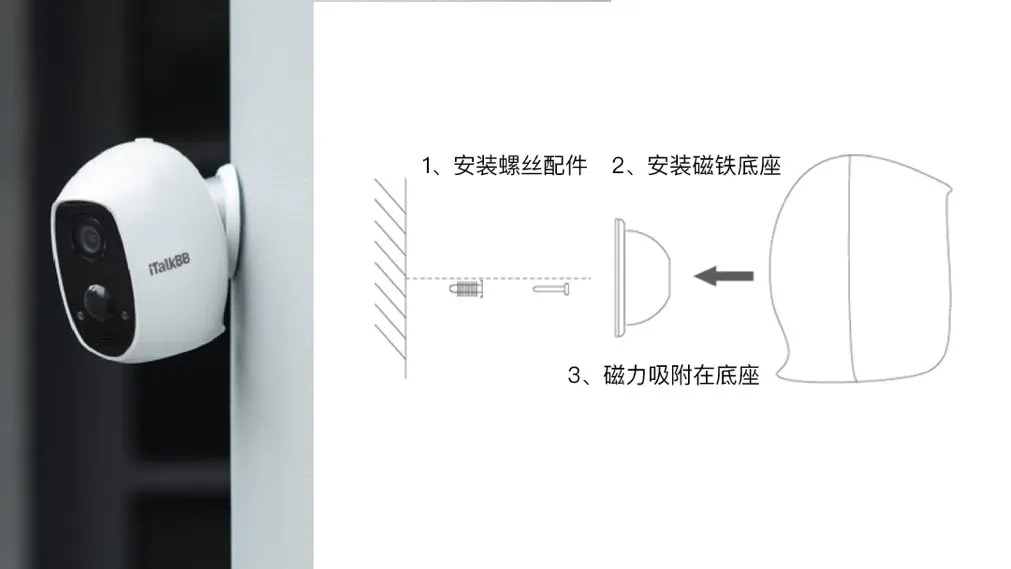

Wireless Setup, Easy Adjustments No wires, no hassle—app includes setup guide

24/7 customer support

Complete installation in just 15 minutes!

Cloud Storage for Video Footage All recordings uploaded to AIjia's private cloud and stored for 30 days

Access and replay footage anytime, anywhere

Download videos to your device for safekeeping

More lifestyle tips and convenient services,

available on iTalkBB's official WeChat account

Scan the QR code or search "iTalkBB" to follow us

Get the latest updates and exclusive Chinese community deals