Feeling Anxious About the Pandemic? Health Insurance Can Help!

Feeling Anxious About the Pandemic? Health Insurance Can Help!

Medical care in the U.S. has always been known for being "expensive" and "slow." During the pandemic, we've seen news stories about "receiving a $400,000 hospital bill after one month of treatment."

In the U.S., due to high medical costs, a serious illness or even just a severe injury can bankrupt an average American family. This is where health insurance comes into play. Health insurance typically covers part of clinic visits, tests, hospitalization, surgeries, and prescription medications. Especially in cases of major illnesses or severe injuries, insurance companies will cover most medical expenses, protecting individuals from catastrophic healthcare costs.

Do I need health insurance?

In the U.S., if you don't have insurance through school, an employer, a spouse, government healthcare, or are over 26 and can't join your parents' plan, you'll need to purchase individual health insurance. In other words, if you don't fall under any of these categories, you'll need to buy your own insurance.

Are there penalties for not having health insurance?

Most states don't penalize the uninsured, but Washington DC, New Jersey, Vermont, Massachusetts, and California have mandates with potential fines based on income.

Can I buy health insurance anytime?

You can only purchase during the annual Open Enrollment period, typically at year-end. If you miss it, you must wait until next year unless you qualify for a Special Enrollment Period (60-day window) due to:

Job loss, losing existing coverage, moving, marriage, childbirth/adoption, new green card/citizenship

Check eligibility here: https://www.healthcare.gov/screener/

Where can I buy health insurance?

1. Health Insurance Marketplace - Submit tax and income documents

2. Insurance Agent - Chinese-language service available

3. Direct from Health Insurance Companies via their websites

4. Employer-Sponsored Plans - Check if family members' employers cover spouses/children (often with no enrollment deadlines and better rates)

What does health insurance cover?

Essential benefits include:

1. Outpatient care

2. Emergency services

3. Hospitalization

4. Pregnancy/maternity/newborn care

5. Mental health/substance abuse services

6. Prescription drugs

7. Rehabilitative services

8. Lab tests

9. Preventive/wellness/chronic disease management

10. Pediatric care (including dental/vision - adult dental/vision excluded)

11. Birth control

12. Breastfeeding support (e.g., breast pump coverage)

What types of health plans exist?

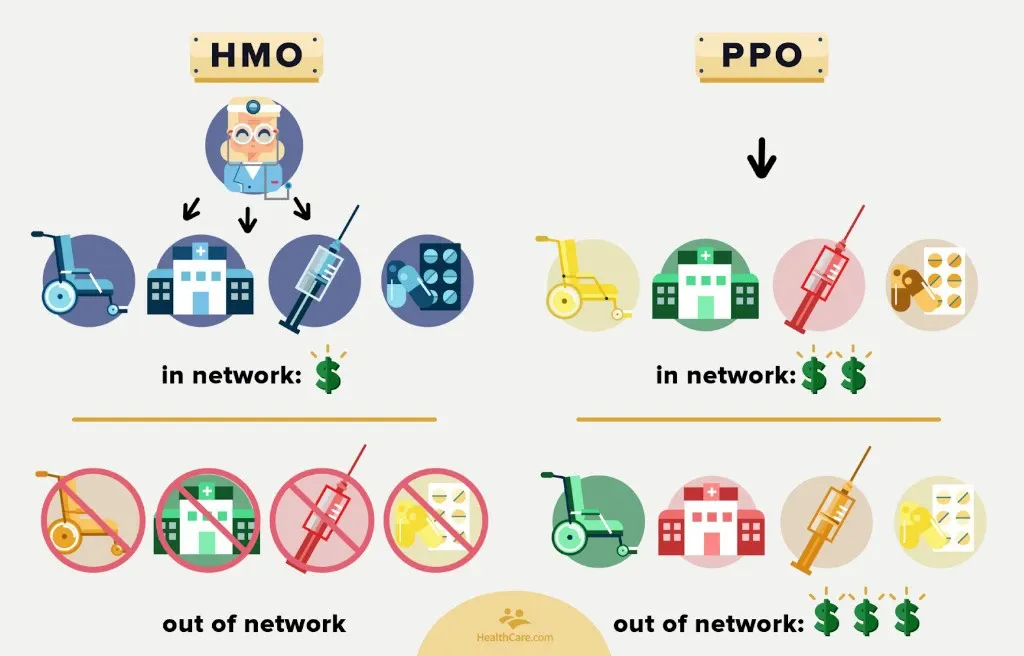

1. HMO (Health Maintenance Organization)

Common plan requiring a Primary Care Physician (PCP). Except for emergencies/OB-GYN, specialists require PCP referrals.

Pros: Low premiums, coordinated care

Cons: Network restrictions, limited specialist access

2. PPO (Preferred Provider Organization)

No referrals needed, covers in/out-of-network care (higher out-of-network costs).

Pros: Specialist freedom, broader provider choice

Cons: Higher premiums, potential out-of-pocket costs

3. POS (Point-of-Service)

Requires PCP referrals but offers more out-of-network options than HMOs.

Pros: More flexible than HMO, cheaper than PPO

Cons: Still requires referrals

4. EPO (Exclusive Provider Organization)

No referrals needed but network-only coverage (except emergencies). No out-of-network benefits.

Pros: Lower cost, no referrals

Cons: Network restrictions

5. FFS (Fee for Service)

Pay-per-service model with broad provider choice but high premiums and upfront payment requirements.

6. COBRA (Consolidated Omnibus Budget Reconciliation Act)

Continues coverage after job loss/career changes - expensive option.

Which plan is right for me?

With so many options, consider these key factors when choosing a plan:

o Premium: Monthly payment to insurer based on age/health. Lower premiums often mean higher out-of-pocket costs.

o Maximum Payment: Insurer's maximum coverage limit. Low premiums may mean inadequate coverage for serious conditions.

o Deductible: Initial out-of-pocket amount ($500-$5000). Some plans offer $0 deductible for higher premiums.

o Copay: Fixed fee per visit/prescription ($20-$50). Frequent care seekers may prefer lower copays (higher premiums).

o Special Limits: Caps on hospital stays, surgeries, mental health, etc. Read fine print carefully.

o Exclusions: Services not covered (varies by plan).

o Emergency Medical Evacuation/Reunion: Covers medical transport and family visitation costs.

o Waiting Period: Some plans require 6-12 months before coverage begins.

How to file insurance claims?

We hope you never need to use your insurance, but if you do, here's how claims work:

1. In-Network Providers:

Present your insurance card for direct billing - no upfront payment needed.

2. Out-of-Network Providers:

Usually requires upfront payment with reimbursement later.

• Submit claim form within 90 days

• Obtain Itemized Bill with provider address, Tax ID, Diagnosis/CPT codes

• Proof of Payment (receipts/bank statements)

After submitting documents (mail/fax/email), you'll receive an Explanation of Benefits (EOB) and check within 10-20 business days.

iTalkBB cares about your health and rights. During these challenging times, we prioritize your needs.

More lifestyle information and convenient customer service on iTalkBB's WeChat

Scan QR code or search "iTalkBB" to follow us

Get the latest news and Chinese-exclusive offers